Bogotá: Cost of Living

How much does it cost to live in Bogotá? A key question for anyone shifting to Colombian capital, whether you are a digital nomads seeking a new hangout, a retiree wanting to stretch out the pension, or anyone looking for a new start in life in South America. Data here is from March, 2024.

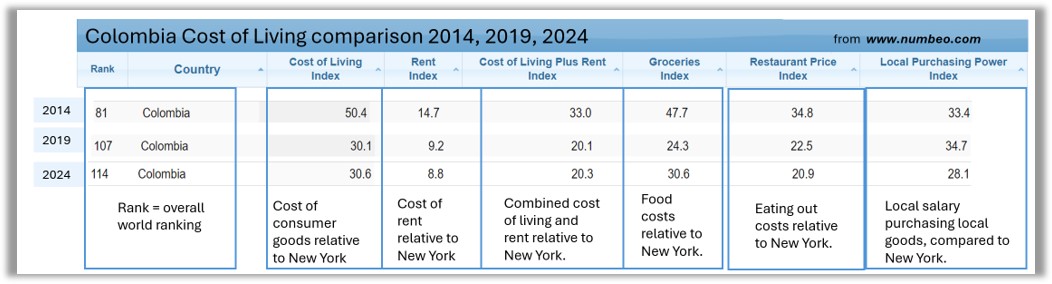

Looking back over 10 years, yes there’s been changes, but the overall picture remains the same: Bogotá is an affordable and stable city to put down roots.

Please post comments below or contact me on colombiacorners@gmail.com for with any feedback or questions.

Putting a figure…

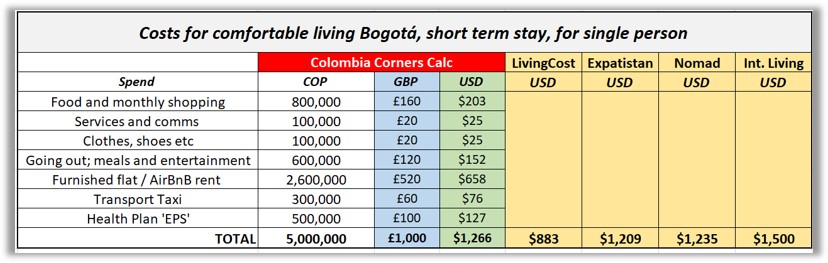

My calculation comes to US$1,266 per month for a single person living comfortably in a small, rented flat in a middle class (‘Estrato 4’) area of Bogotá. That’s GBP £1,000 a month, or EUR €1,170.

Prices are from March 2024, with an exchange rate of

- 5,000 COP (Colombian Pesos) to £1 (UK GBP)

- 3,950 COP to $ 1 (USD).

- 4,333 COP to €1 (EUR)

Of course, there are many variables, so read on for more details and some price comparisons with London and New York (currently two of the most expensive cities in the world). The data presented below is from multiple sources and my own calculations based on living in Bogotá for more than a decade. I’ve also included some tips on how to reduce costs.

Why Bogotá?

Bogotá is a mega-city of officially 8 million inhabitants (though probably many more) set deep in the Andes (at 2,550 metres, or 8,400 feet) with a temperate mountain climate, but a few hours’ drive from tropical jungles, deserts, and plains. New arrivals to Bogotá might feel a bit of soroche from the thin air but most people quickly adjust, see my post Do You Have an Altitude Problem?

The big bustling city covers hundreds of local barrios which are often self-contained communities with shops, services and entertainment to meet most needs, a theme I explored in the post ‘Is Bogotá a 15-Minute City?’.

The ‘Estrato’ System

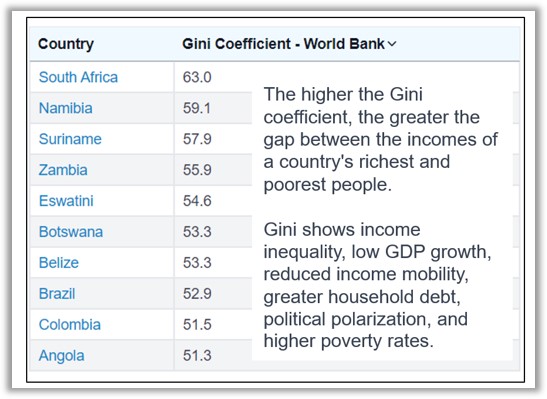

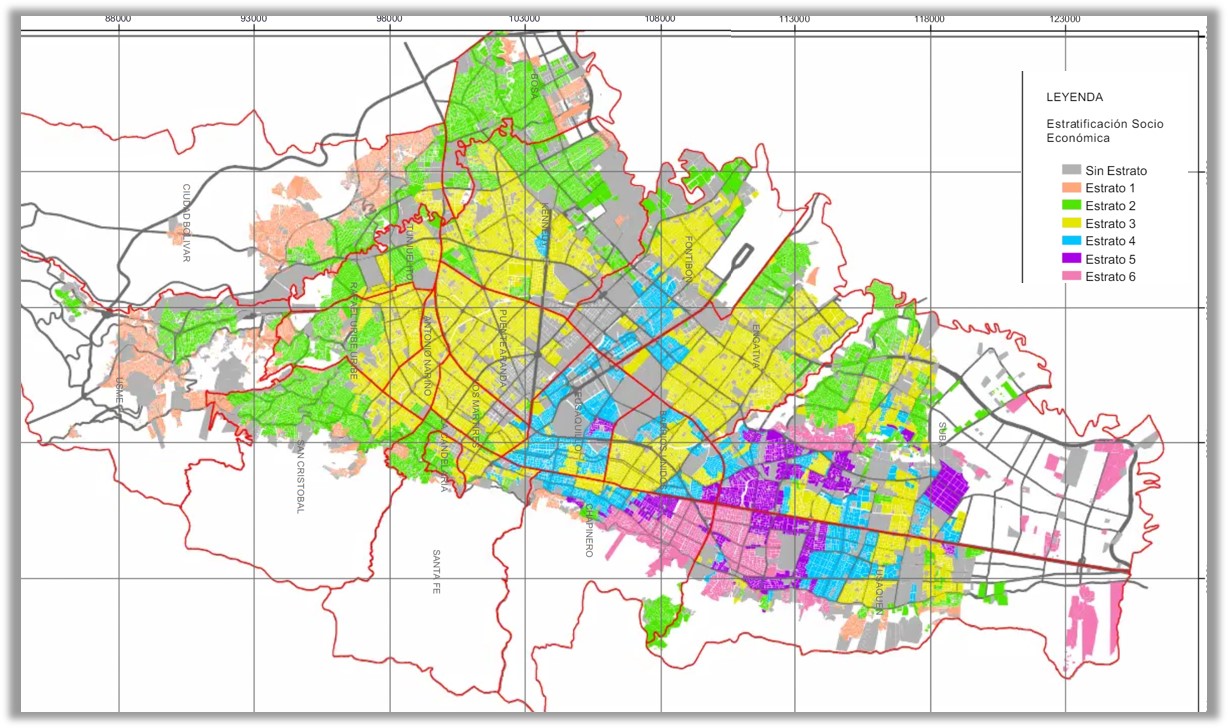

In Bogotá you need to get your head around the ‘estrato’ zoning system, a socio-economic classification for barrios and even city blocks. This might stem from the fact that in terms of livelihoods, Colombia is one of the most unequal countries in the world, in the bottom ten worldwide for variation between very rich and poor (the GINI index), and Bogotá has extremely wealthy and very poor areas.

Of course, every city has its mosaic of areas. What’s interesting in Bogotá is how it is officially divied up. The estrato system is also important for anyone moving to the city, since the level will impact on costs, particularly accommodation.

Here’s the official list:

- Estrato 0: homeless and street people.

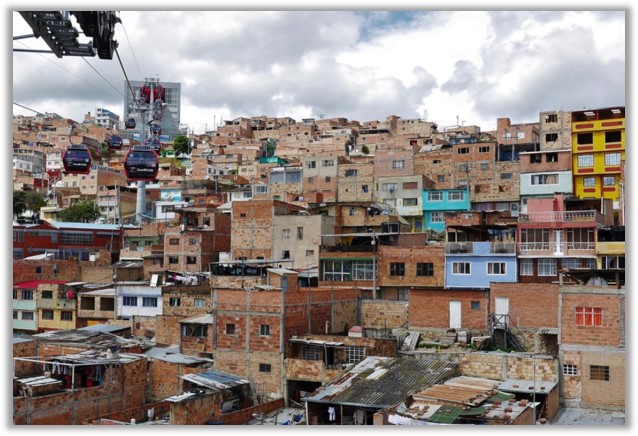

- Estrato 1: very poor areas, including temporary shelters and informal settlements.

- Estrato 2: poor barrios populares, basic buildings with connections to public services.

- Estrato 3: lower middle-class barrios, cheap but liveable, where most Bogotanos reside. These zones are all over the city.

- Estrato 4: middle-class barrios where many teachers, academics, retirees live.

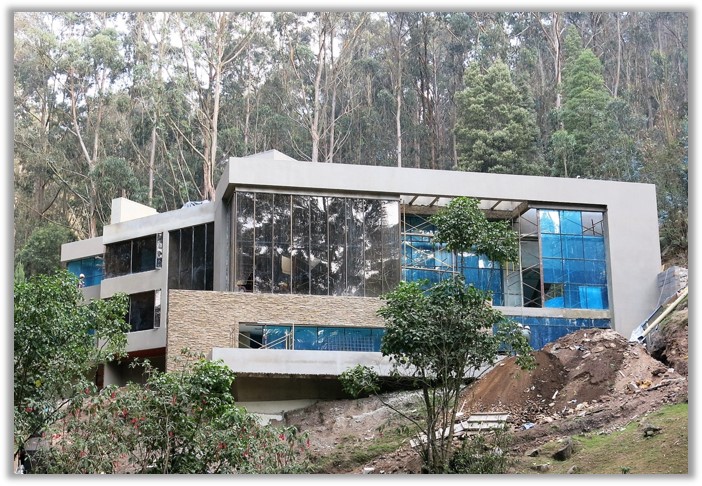

- Estrato 5: upper middle-class zone with houses and upmarket flats.

- Estrato 6: extremely wealthy residents often in gated communities.

Public services costs such as gas, water and electricity are pegged to the estrato (the lower areas cost less) but also informally in costs such property prices, rent, and in groceries, clothing, restaurants etc. As a generalisation, lower estrato zones generally have higher crime and homicide rates, presence of gangs, higher air contamination and less services. But don’t assume they are more dangerous to live in as a foreigner, as long as you fit in. In fact, some ‘uptown’ barrios can attract more crime because more people are worth robbing.

Most Estrato 1 and 2 zones are in the south of the city and most Estrato 5 and 6 barrios are in the north-east of the city, though some localities are a mosaic; Chapinero, for example, ranges from Estrato 1 to 6, with barrios at the two extremes within a kilometre of each other. You can download estrato maps here for each Bogotá locality.

Overall, I would recommend Estrato 4 as good areas to live, though some folk on a tight budget might opt for Estrato 3 or even Estrato 2. Speaking some Spanish will help fitting into to lower estrato zones.

If you are new to the city and want to visit Estrato 1 and 2 areas, see my posts Entrenubes: The Best View in Bogotá? and A Day Trip to Ciudad Bolivar and Riding Bogotá’s TransiMiCable.

Other posts on Bogotá that might be useful are: Is Bogotá Safe: 2023, an overview of earthquakes here Not Quite Quakes And a fun look at the changeable weather: Bogotá’s Weather, Anyone’s Guess.

The Cost Calculation

The table below shows my cost calculations, and comparisons with websites publishing similar data; my total of US$1,266 is close to the average.

The two main factors affecting costs for expats living in Bogotá – assuming they have a hard currency income, US$, Euros or pounds for example – are local inflation and currency exchanges.

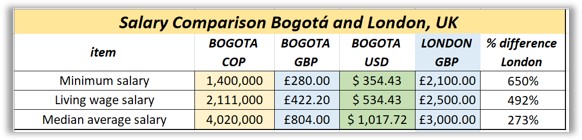

Inflation has been running at 4.5% average per year for the last decade in Colombia, and as high as 10% post covid, and in Colombian pesos (COP) many things are close to twice as expensive in 2024 as they were in 2014. In the same period the local minimum salary has doubled, and property values also doubled.

Meanwhile hard currency exchange rates have also doubled in the same period; in 2014, the USD as US$1 =1,950 COP and in February 2024 was at 3,950 COP.

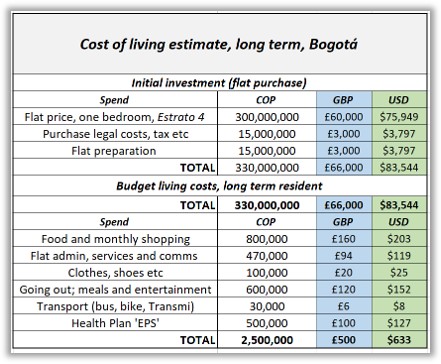

How much does it cost to buy a small flat and live in Bogotá? See the chart, right, for a breakdown.

In the sections below, I go into more details of where these costings come from.

Rising Costs of Big Cities

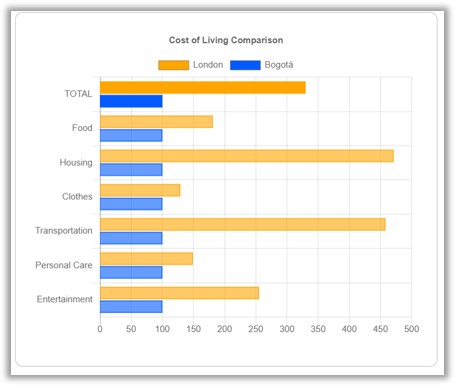

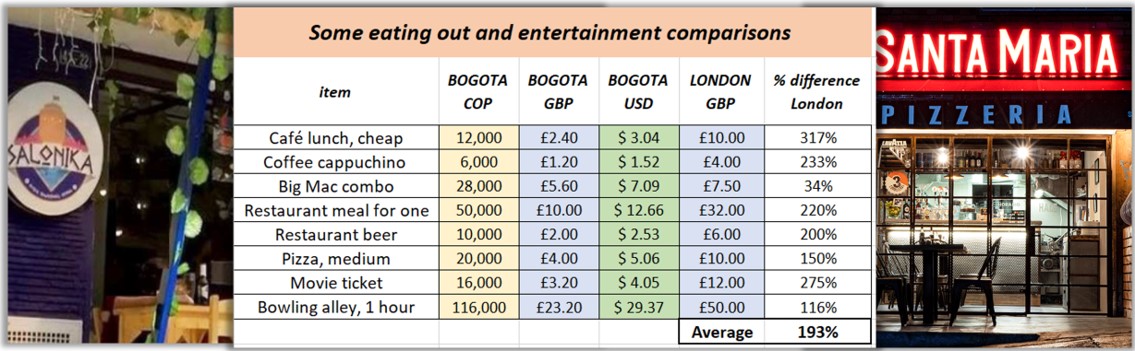

OK, so another trend is that major cities like New York, London, Paris etc are now stupidly expensive, and getting relatively more costly than cities like Bogotá, as you can see in the table below.

The main point here is that, yes, Bogotá is getting more costly – but relative to other world capitals is getting cheaper:

- In 2024, living in London is 3.5 x more expensive than Bogotá (numbeo.com)

- In 2024, living in New York is 4.6 x more expensive than Bogotá (numbeo.com)

This explains why so many expats are rocking up in places like Colombia; they are being squeezed out of an affordable life in their home countries.

The bad news is that in Bogotá local spending power – earnings in Colombian pesos – are falling behind compared to other cities, suggesting more hardship locally and a wider gap between the world’s wealthy ‘north’ and poorer ‘south’.

This means people earning locally are poorer than 5 or 10 years ago; something to keep in mind before complaining about the cost of your Juan Valdez cappuccino.

See my post ‘Down and Out in Bogotá‘ for stories from habitantes de la calle.

Where the Money Goes…

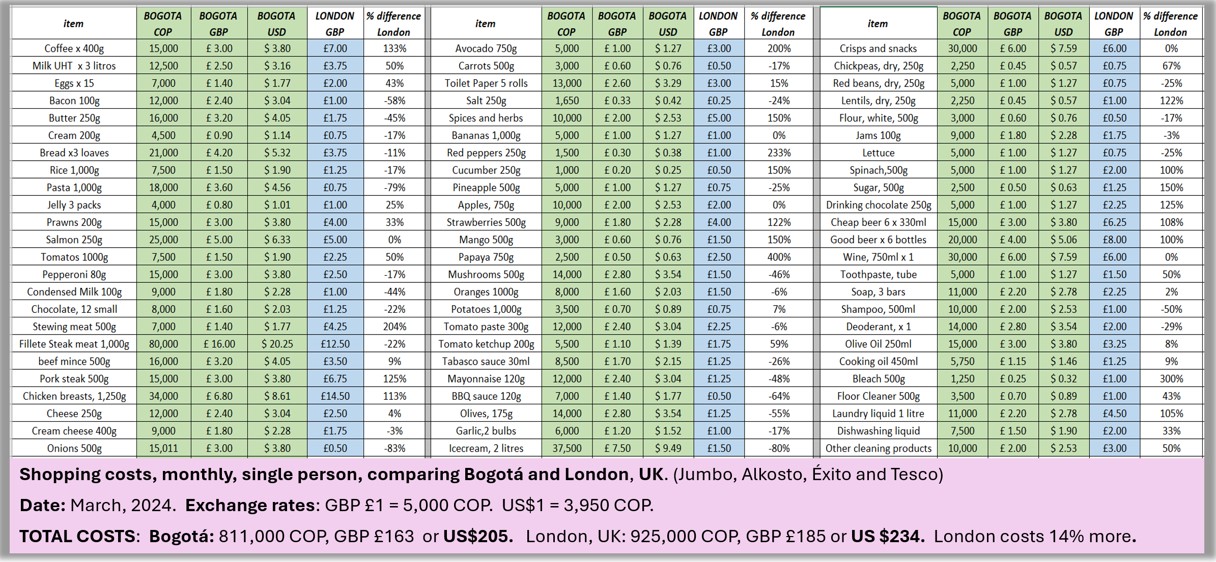

Not everything is much cheaper in Bogotá, in fact some a whole bunch of items in your supermarket trolley would cost less in London’s Tesco than Bogotá’s Exito (mayonnaise, olives, mushrooms, a good bottle of wine, shampoo, carrots and, yes, pineapples!). By my (March 2024) calculation, the Bogotá monthly grocery shop is only 14% cheaper than London, assuming you buy in a supermarket (local fresh markets will be less, I’ll come to that later).

It’s worth noting too for some costs (i.e.) food shopping, Bogotá is cheaper than lowland cities (Barranquilla, Cartagena, Cali for example), and around the same costs as Medellin. This is unusual for a capital city and reflects that while the city has some crazy expensive areas – Rosales for example – it is mostly inhabited by a large, poor population, with correspondingly cheap areas. On a more positive note, it is also at the heart of a massively productive agricultural area – the Andes – another reason to cut costs by buying local produce.

The big differential in costs, as the numbeo graph shows, right, is in accommodation, which has an outsize impact on overall monthly costs as it takes the biggest chunk of our spending.

Another area where Bogotá is much cheaper is in transportation, though you can argue that in terms of quality the London mass transport system (mostly tube trains) far surpasses Bogotá´s crowded buses. In this case, you get what you pay for!

The Monthly Shop

Food and groceries come in at just over US$200 a month for a single person, in a supermarket, 14% cheaper than similar products and quantities in London. The table below gives a detailed comparison.

The relatively high prices in Bogotá reflect the transportation costs (over slow roads through the Andes) and unsubsidized and labour-intensive farming (potatoes being hoed by hand on small family farms on steep hillsides) and taxes on imported goods. US and UK also have more competitive food outlets, whereas Colombia has ‘cartel’ prices to the detriment of the consumer.

Shopping Top Tips

- Avoid imported products which can be crazily expensive. Tropical products (mangoes, pineapples etc) also come at a premium because of high transport costs. Local Andean produce is usually the best value.

- You can save around 10% by avoiding the large supermarkets and using corners shops and smaller discount chains such as D1 and Ara.

- For bigger discounts – around 30% – by visiting the labyrinth-like Plaza de Paloquemao, a wonderful fresh food market, close to the center of the city, with every imaginable local product and many imported and specialist food items much cheaper than supermarkets. It takes time to shop there and find your way around but is worth the effort.

- There is bulk warehouse shopping in outlets like Alkosto and Pricesmart (with a membership scheme), prices can be up to 50% cheaper than supermarkets, but you need to buy in bulk and find storage for the products.

- Eat out to save cash! The dailylunchtime corrientazo set menu (see below on Eating Out) is healthy fresh-cooked food often cheaper than buying and cooking the same products at home.

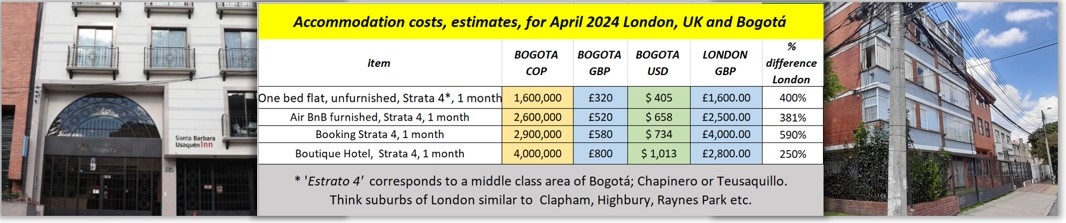

Where to Stay

Start off in temporary accommodation, i.e. – furnished flats with services included – such as AirBnB, or Booking.com which is more affordable with the monthly rate, or you can try negotiation with the owner for a longer-term deal. I’ve used a 2024 price of US$640/month, for a basic place in ‘Estrato 4’ area of the city.

How to Rent in Bogotá

- Avoid the real estate platforms (ie ´Metrocuadrado and Finca Raiz) as flats tend to be more expensive and owners advertising here tend to demand unrealistic paperwork (your great-great-grandmothers birth and baptism certificates and at least two ´guarantors´ for your tenancy!)

- Instead, find the area of the city you want to live in, then walk/cycle around noting down phone numbers for flats to rent. Some building to not allow the flat owners to post large signs, so check with the building reception (if there is one) for a more discrete list of flats for hire.

- Call the owner direct, if possible, and arrange a viewing. Always try and negotiate the price down, by around 20%, everyone expects that.

- Be clear in the agreement on the length of tenancy (usually 6 or 12 months initially), the notice period to break a contract (‘aviso’, 2 months is ideal), any building monthly administration charges. (‘administración’‘) In Bogotá, these should be included in the monthly rent, but check. Also what, if any, services (water, electricity, gas, Internet) are included. Usually none.

- Cash deposits for flat hire are technically illegal, but the owner might demand one if you have no Colombian guarantors. In this case negotiate to pay the rent two month in advance, this usually keeps the owner happy.

- Rents rise annually on the anniversary of the initial contract by the ‘IPC’ (consumer price index) which in 2024 was 9.5%.

- Property rental contracts automatically roll over for the same time period unless one of the two parties (owner or renter) advises the other in writing of their intention to end the contract.

- Flats are hard to find in February when students go back to university, and flats fill fast. Accommodation is easier to pick up in November/December, when the same students leave them empty.

- What equipment is included: usually a water heater and a cooker. Some flats also throw in a fridge, some furniture.

Top Tips: keeping accommodation costs down

- Sharing a house or larger flat will reduce costs.

- Go downmarket. My estimated price (over US$400) is for the Estrato 4 (middle-class) area. You will find flats for rent for US$150 a month in Estrato 2 and US$250 in Estrato 3 zones. Obviously balance this against security of the area and the loud music.

At the end of this post, I have put some tips on Buying and Furnishing a flat in Bogotá.

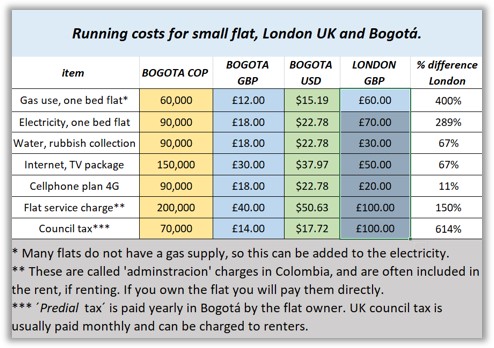

Service Charges

Running costs should be all included in AirBnBs and similar short-term rents. Services for a small single-room rented flat will max out at around US$100 per month, including Internet. If you are buying your own flat, you have taxes and monthly building fees to pay, another US$70 per month. This is around 30% of what you would pay in London, UK, and 25% of the prices in New York.

Electricity, gas, water: usually included in AirbnBs and short-term lets (one or two months). Long-term rentals will expect you to pay these bills monthly, at around US$60 a month.

Internet/Phone/TV: also included in AirbnBs and most short-term lets. Longer rentals might include the Internet, which is useful, or require you to pay it directly or even get your own contract with the Internet provider, which can be a headache. Many Colombian ´move´ with their Internet contract i.e. shift it from flat to flat, which means many landlords don’t bother to install it themselves. Minimum cost for just-broadband in a small flat is US$32/month. Some companies insist on selling you an expensive package i.e TV and landline phone too, around US$50, which you don’t need. In this case insist you are a ‘small business’ working from home for the cheaper internet alone. Claro, ETB, Movistar are the main providers; ETB is best in my experience.

Building Management Fees: known here as ‘cuotas de administracion’ or simply ‘admon’, these are monthly fees paid by every flat for running of the communal aspects of the building. Costs can be very high i.e. up to US$250 a month for a luxury flat in a building with a gym, swimming pool and 24-hour guards, or as low as US$10 per month for a basic building with no frills.

Usually in Bogotá, the flat owner pays these bills, but in some cases, they require the tenants to pay. Be clear in this when renting a flat, and ensure it is clear in the contract. If you buy a flat then you will have to pay this yourself, as well as any ‘cuotas extraordinarias’ – extra quotas – your contribution for any large-scale work on the building such as replacing the roof.

Building fines: many buildings impose small fines (US$10) for resident who infringe rules (usually related to security, i.e. leaving the main door unlocked). These should be paid by the tenant (and willingly!) if you are the guilty party. Ensure when you rent that you are aware of the building rules, these are enshrined in the Manuel de Convivencia (Co-Living Manual) which the owner should share with the tenant.

Council Tax: Impuesto Predial, annual council rates charge, paid by the owner, for a small flat in 2024 was around US$170 for the year.

Keeping Healthy

Bogotá’s altitude keeps it mosquito-free (they can live here but can’t breed) and the city does not suffer from a host of diseases that plague lowland Colombia; malaria, yellow fever, dengue, chikungunya, zika to name a few. You might get a bit headachy from the altitude at first, but that goes after a few days. Despite claims the water is safe to drink, it isn’t reliable and frequently contaminated (I´ve tested it) so use bottled water or a filter jug if you are here for a short time, or plumb in a (Grival) water filter if here for a year or more. Wash salad veggies with a dash of chlorine; it’s not uncommon in the Andes to fertlise plants with sewage outflow.

Air contamination can be a problem, particularly in the south and west of the city (less airflow, more pollution), and smokey trucks and buses combined with high altitude can cause lung problems; some folk prefer to live slightly higher up the mountain in barrios like La Macarena, Alto Chapinero etc. Electric and gas buses have reduced pollution in recent years.

In 2023, Colombia was ranked 36 in the world in terms of health care systems, just behind Canada and the UK, but way above the US (at 69th place). The national ‘EPS’ system is a public-private construct with Colombian signing up to private insurers (the EPS companies) that channel them to a wide range of private health providers (IPSs), with oversight by the health ministry. It works OK in cities and large urban areas but is inefficient or inexistent in deep rural zones.

Note: in 2024, the Petro government was trying to reform the EPS system with a controversial plan to shift to a public health system, this will probably fail – there are powerful political interests behind the privatised model – but has created uncertainty in the health sector. One of the larger EPSs, Sanitas, was put under government administration in April 2024, after financial losses, with Petro accusing the partly foreign-owned insurer of skimming profits, and in turn the EPS accusing the government of not paying its part. For now Sanitas is still functioning, though who knows for how long…

Signing up for EPS Health

In theory, expats on an R (Residence) visa can sign up to the EPS system as soon as they have their Cedula Extranjeria (national CE ID card usually issued soon after getting your visa). Recent immigration rules (2022) suggest that professional workers, business owners or investors on the M visa can also apply.

Anyone living long term in Colombia is strongly advised to ‘affiliate’ to the EPS system; it provides good basic health care, usually nearby. Also worth noting that EPS cannot exclude patients based on pre-existing medical conditions.

Other options are an international insurance scheme or buy a Colombian private insurance that is outside (and more expensive) than the EPS scheme. Your call.

Short Stayers and Digital Nomads

According to recent visa rules (Ministry of Exterior Relations, Resolution 5477 from 22 July, 2022) any V-short stay visa holders, including Digital Nomads, must have a “health policy that covers the national territory against all risk including accidents, maternity, injury, hospitalization, death or repatriation, for the expected time in the country”.

This is a bit vague about how or where you get the health cover and does not seem to specifically exclude the EPS scheme. Many expats on V visas report that their Cedula Extranjeria (CE ID card) has allowed them to join an EPS, no questions asked…

Of course, the EPS will not cover ‘repatriation’, but note that the clause above says: “or repatriation”, i.e. optional. This means that legally you can be covered by a locally purchased private health insurance plan, which will be cheaper than the international one.

Since the main EPSs also offer private insurance schemes, the best approach is to get down to one the offices of the EPS and check with them what coverage you can get (under the national scheme or a private health plan) depending on your visa status.

For anyone on a V visa and a tight budget, the EPS scheme is the cheapest, so it’s worth to try to affiliate, with a local private health plan as the next choice.

EPS: Sanitas, Sura and Compensar

Sanitas, Sura and Compensar are three recommended EPS in Bogotá. You sign up then pay a monthly fee which varies from US$50 to US$200 depending on your declared income, then a small fee (´bono’) for each medical intervention (lab, medicines, or health visit) which also varies from US$1 to around US$20, again depending on your status. For EPS There are no ‘health pre-conditions’ restrictions to signing up, like in the US.

Some medical procedures or non-life-saving surgeries will require a ‘co-pago’ – co-payment – that the EPS can legally charge, but these don’t usually break the bank.

For some weird bureaucratic reasons, the EPS’s also can routinely deny some complex treatments…and then encourage patients to sue them to get the approval! Many Colombians are familiar with this tutela system, and the EPS’s have a website where you can upload your legal document…and wait.

In some cases, EPS treatment is free, for chronic diseases or if you are diagnosed with certain ailments, for example a small skin melanoma could trigger free follow-ups and treatment for skin problems, or high blood pressure could enrol you into a free health check program and medicines.

The system allows for huge flexibility: your health records are online, you also have your own print-out copy, and you usually have a choice of ‘any doctor anywhere’ for an urgent visit the same day, or the next day, or maybe a week’s wait to see a particular medic.

Waiting time can vary; usually you can get lab tests done within a few days, and simple diagnostics (ultrasounds, MRIs etc) within a week. Specialist care (endocrinologists, ENT, gastro etc) can take weeks or months.

OK, so how much will you actually spend? I have budgeted 500,000 COP or US$127 per month, which would cover an EPS health plan and one or two medical needs per month. You could spend a lot less.

Premium and Private Health Schemes

Plan Premium: or Premium Health Schemes: an add-on to the EPS plan, with fast-track for certain specialities. You need to first join the regular EPS then request the premium service, which can cost around US$25 extra a month.

Medicina Prepagada: these are private health scheme, with access to the top clinics, and can cost much more than the EPS scheme, starting around US$300 per month. Unlike the EPS plan, the private schemes can restrict access or up prices depending on your age and pre-existing medical conditions. Many EPS insurers also offer Medicina Prepagada i.e. Sura and ColSanitas. Users of these plans can opt out of the regular EPS system, you don’t need to pay twice!

Pick’n’Mix Health Plan

I use my own ‘pick’n’mix’ health plan; using the EPS for most routine stuff but occasionally go private and pay directly for stuff such as a yearly heart check, dentistry. Bogotá has a vast network of private clinics, specialists, and diagnostic health services where you can call and make a “cita particular” (private appointment) often at short notice.

Generally, I trust the EPS system, but sometimes it’s good to have a second opinion with a private specialist, that can cost around US$40.

Getting Around

Bogotá is close to a ‘15-minute-city’ where most of what you need is a walk or bike ride away, and neighbourhoods like Teusaquillo and Chapinero are self-contained for health, services and shopping.

When you do need to move across the city, Bogotá has a poor road infrastructure, traffic jams and a crowded and frequently insecure bus network of Transmilenio bendy buses, (faster, with their own lanes) and more local ‘SITP’ buses (often stuck in traffic). The system covers every corner of the city but can be slow or packed like sardines. Plan any journey across town outside of peak hours, which are working days from 7am to 9am and 3pm to 8pm. See my post Getting on Bogotá Buses for more info.

On the plus side, Bogotá has a vast network of bike lanes, where you can also ride electric e-bikes and scooters, and very cheap taxis for a capital city, with an airport run costing under US$10, and platforms such as Uber, Cabify and Didi. Local trips can cost as little as US$2.

Driving your own car in Bogotá is pointless, considering the traffic and restrictions on private cars (with a ‘Pico y Placa’ scheme which means 10 days a month you cannot use it in daylight hours). The only reason to own a car is to make long trips outside of the city, which is what I use mine for; see this post Backroads of Santander for a typical excursion.

If you do buy a car, buy a cheap older 4×4, costing around US$12,500, see below. Remember you will need to get a pase, or Colombian driving licence, which means passing a few tests. Foreign licences expire here as soon as you get your cedula ID card, or after 6 months in Colombia, whichever is sooner.

You also need a yearly mechanical check (revision tecnomecnica) which can cost around US$100 assuming some minor mechanical adjustments, a yearly compulsory 3rd party medical accident insurance (SOAT) around US$300/year. Other insurance is optional, though I buy a 3d party damage policy for 30-year-old car for around US$300/year.

Mechanical costs are variable; buying a common local car model with available spare parts will reduce costs. See my blog post on Colombia’s classic 4x4s.

Overall budget at least US$200 a month to run a small 4×4 car, as a low estimate.

Top Tips for Transport

- For riding errands around the city, buy a cheap or second-hand mountain bike (look on Facebook forums) and keep it looking scruffy, and buy a good lock (I ride a US$40 bike, having had two new bikes stolen over the years). If you are a serious cyclist, you can keep your classy bike for weekend rallies and Sunday Ciclovia.

- Learn the bus routes and how to get around, use Movit or Google Maps for public transport options and times. Keep valuables hidden and bring a good book.

- Always carry spare change in your pocket when riding the Transmilenio; there will be plenty of beggars, hawkers and buskers asking for help. The few coins you share are the Colombian social security system.

Getting Out….

Going out in Bogotá is around a third of the cost of London, unless you are eating at MacDonalds, or another fast food joint, in which case Colombia is only marginally cheaper than the UK. This is because big chain restaurants are seen as ´luxury´eating options in Colombia. Don’t worry, there are many other budget options; every barrio has at least one cheap rotisserie chicken restaurant (pollo asado) where a family of four can chow down for US$12.

Another deal is the Chinese takeaways now all over the city; the fried rice is so ample, a single portion (US$5) feeds my whole family, with leftovers. There is plenty of street food too, with an arepa rellena – stuffed with cheese – feeding millions of rolos every morning on their way to work. Expect to pay under $US2 for a filling breakfast and weak milky coffee.

And dont forget the corrientazos – cheap set meals – served in the host of humble cafes in every corner of the city, usually only on weekday lunchtimes. The food is hot, freshly cooked, and comes with soup then a main dish with a protein (usually beef, chicken or fish), beans or lentils, rice, salad and a glass of natural juice.

These lunches seem to shadow the estrato system, with prices to match; white-collar workers will gravitate to the ejecutivo lunch spots and ´gordon blue´cuisine (around US$5 a dish) whereas the lads from the building site will crowd into a cafe with plates at US$3. The corrientazo is such good value because it is bulk produced. If you order off the menu in the same restaurant it will cost double. The set menu is cheaper than buying the same food and cooking it…so anyone on a tight budget should check out the local options. Note there are increasingly small restaurants offering vegetarian and vegan food.

Buying a Flat

You can buy a small flat in Estrato 4 here for US$76,000 – five times less than New York. As with renting, Estrato 2 and 3 will be cheaper. Buying property is a big topic, which I will cover in a separate blog post; but in summary, flat purchase is easy in Bogotá and can be fast (you can get possession in a month). Note: some people buy property to qualify for an investment visa, this requires a higher purchase and expert legal advice.

Top Tips for purchasing a flat in Bogotá: putting visa issues aside, some recommendations:

- Only buy after you have already lived In Bogotá a year, know the city, chosen your estrato, have opened a bank account, and have learned some basic Spanish.

- If possible, move purchasing funds to your Colombian bank account. Having funds available will greatly increase your negotiating power with any purchase. Some owners will accept part payment overseas.

- Same as with renting, walk the zone of interest and note down numbers in windows to arrange viewing appointments.

- Look for an old flat in a building from the 1950s or early 1960s (better built, less noisy), best flats are with an east or west aspect (more sunlight, less heating bills) on the third floor of a building with maximum 5 stories and no lift (which adds to management fees).

- Carefully check monthly admin fees (meet the building administrator) as these vary. The monthly fee for a small flat in a small building, say 12 units, should be under 200,000 COP (US$50) a month, depending on the communal services provided.

- Early on insist to meet the legal owner and negotiate directly.

- Ask for a recent copy of the Certificado de Tradiccion which to check against the owner ID.

- Ask the owner for a copy of the latest ‘catastral’ city councilevaluation, this is usually around 70% of the commercial price, and can act as a price guide.

- Offer around 25% less than the owner asking price and be prepared for price ping-pong. Remember that the property market can be very slow in Bogotá, so some owners will accept a low offer if they need a quick sale. A fast purchase can be your best bargaining tool. Don’t be shy to put in a silly offer; you might get lucky.

- Allow at least 20% more on top of the purchase price for legal fees and basic upgrading. If the flat requires extensive remodelling (plumbing, electrics etc) then factor this in the purchase negotiation.

You pay yearly council tax on property (predial) to the Bogotá city council, rated on the property official value (valu catastral). For a small flat in 2024 this was around US$150.

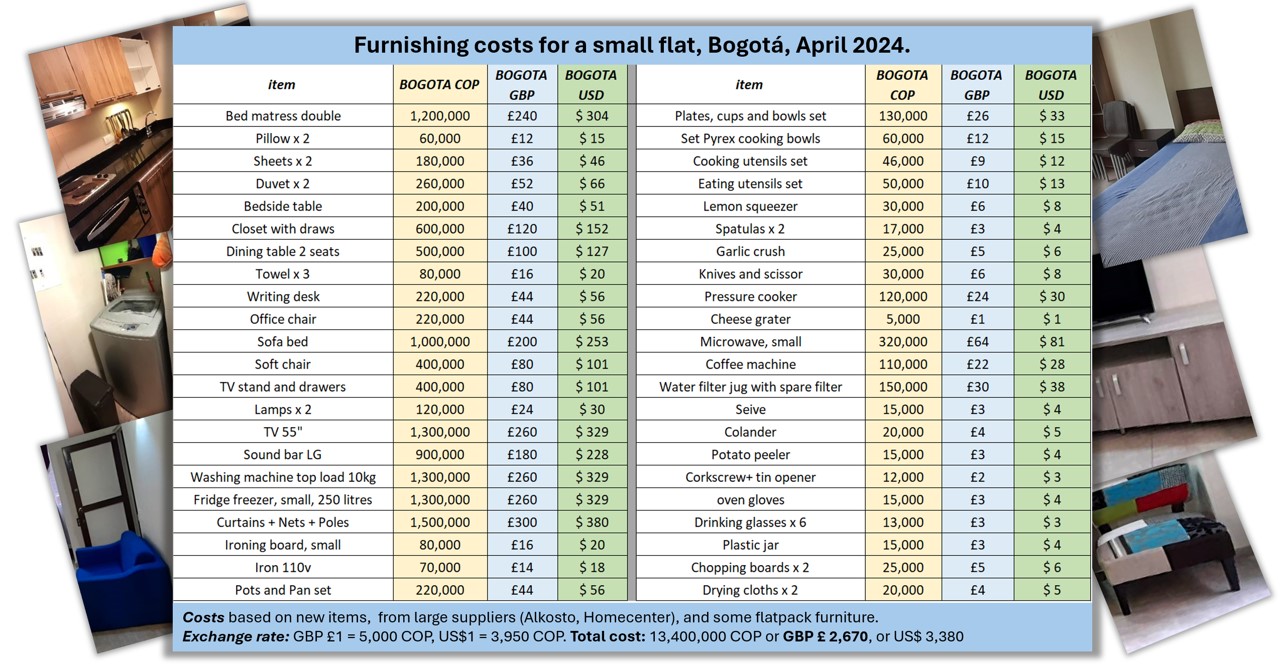

Furnishing a Flat

Basic furnishings from a generic outlet in Bogotá (Homecenter, Home Sentry, Alkosto, Ikea) will cost over US$3,000 to fully kit out a small flat. However, there are many ways to do this on the cheap, and you can probably reduce costs to under US$2,000:

Top Tips for cheap furnishings.

- For small household items, Dollar City has some good cheap kitchenware etc.

- Look at Facebook groups (ie Marketplace, Expats in Bogotá) for second hand stuff.

- Visit the flea markets in the city centre (Septima with Calle 13) on Sundays.

- Check out second hand furniture shops, there are many in Chapinero.

- You will often find ‘garage sales’ on Sundays, often nearby.

Future Prospects

What will the future hold? Colombia is today a remarkably stable place considering its turbulent history, inequality, and recent shift in 2022 to a left-wing government, overturning a trend of decades of right-wing governments. The widely-predicted currency crash never happened, and the Colombian peso continues to hold its own against the US$. There is no reason to expect the country to plunge into economic or a deep social crisis in the future. More likley things will muddle along or slightly improve.

Not to say there isn’t social unrest – and Colombians have much to protest about – but there is a trend towards tolerance perhap missing in many other countries. In an increasingly crazy world, Bogotá could be a safe bet….